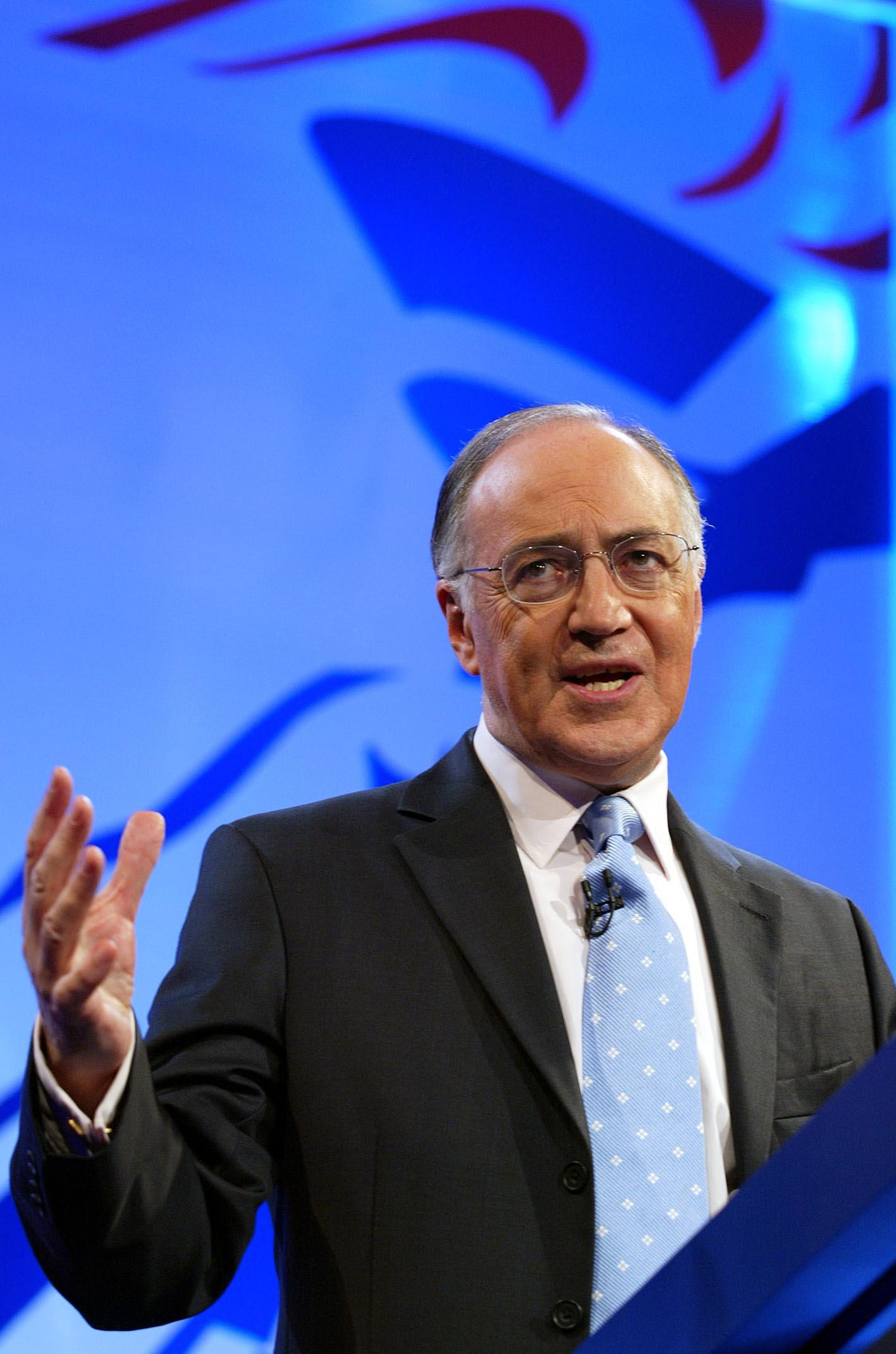

The speech made by Michael Howard, the then Shadow Chancellor of the Exchequer, on 12 April 2002.

May I begin by expressing my gratitude to the Centre for Policy Studies for allowing me to give this, the second of a series of speeches on the framework of economic policy, at the Centre. The Centre has, of course, a long and distinguished history of offering a forum to Conservative economic policy makers. I am honoured to be following in that tradition this morning.

Last month, I made the first of this series of speeches at the Institute of Public Policy Research which is, if not exactly a sister organisation of the CPS, then perhaps a cousin across the water.

In that speech I made three points. First, that the current Government’s approach to monetary policy is an evolution of the policy that the Conservatives began to put in place in the 1990’s and not, as the Government maintains, a decisive break with the past. Secondly, that the transfer of responsibility for setting interest rates to the Monetary Policy Committee of the Bank of England has been a successful further stage in that policy, for which the Chancellor deserves credit. And thirdly, that that evolution must be maintained by implementing even greater objectivity and accountability in framing monetary policy.

My main message was that, in monetary policy at least, there is now a very considerable degree of economic consensus. That consensus, and the stability and continuity which spring from it in economic affairs, is greatly to the advantage of our economy and is a matter for celebration.

Today I want to talk about the framework for fiscal policy. Here too there are some points of consensus and here too that is to be welcomed. Unfortunately, however, the scope for consensus is somewhat more limited in this area for reasons which I hope to make clear in the course of this speech.

In terms of short-term economic management, of course, monetary policy is a much more appropriate tool than fiscal policy. Fiscal policy, however, has a very important and powerful influence on the economy’s medium and long-term performance. And it must be conducted in a manner that supports the work of the central bank in running monetary policy directed at achieving an inflation target.

This leads to one clear and rather obvious difference between the framework for monetary policy and the framework for fiscal policy. While the task of short-term economic management based on monetary policy is now broadly apolitical and the responsibility of the Bank of England’s Monetary Policy Committee, the conduct of fiscal policy remains clearly the political responsibility of the Chancellor of the Exchequer.

But first, I perhaps ought to make clear that there is one area of fiscal policy which I shall not cover at any length or in any detail this morning. I have already set out my firm belief in the proposition that, other things being equal, low tax economies are best. They are, in general, the most dynamic economies, the most innovative economies and the economies which do most to enhance the material welfare of the people who live and work in those economies. Other things are not, however, always equal. There are from time to time moments in a nation’s economic history when other things have to take priority. As I have also said before the present crisis which we face in our public services is, I believe, one such moment. This does not mean that, as a nation, we should pour endless amounts of taxation into the bottomless pits of unreformed public services. It does mean that the public services must be put first and that the provision of the resources which are necessary in order to meet the current crisis may have to take priority over tax cuts.

But today I intend to concentrate on the Government’s approach to the framework for fiscal policy and some of the key principles which Governments should apply in this area.

THE PRINCIPLES OF FISCAL MANAGEMENT

The current Government has set out five principles of fiscal management – transparency, stability, responsibility, fairness and efficiency.

It implies that these principles are somehow new. And it makes yet more fundamental claims. In the recent Treasury book, “Reforming Britain’s Economic and Financial Policy”, which no doubt you have all read and which some of you may realise has now become my nightly bedside reading, the authors Ed Balls and Gus O’Donnell, assert that ‘a consensus has emerged in support of sound public finances as the principle medium-term objective of fiscal policy.’ Such a consensus, they claim, ‘grew out of the experience of the 1970’s and 1980’s which saw a relaxation of fiscal discipline.’

Not for the first time in their volume, they claim too much. The very phrase, ‘sound public finances’ could have been lifted from virtually any of the speeches of Margaret Thatcher or any of her Chancellors. To the extent that there is now consensus around the need for sound public finances, that consensus hardly arose because of Labour’s actions. Indeed, even now, there seems in Government circles to be little recognition of the trade-off between high tax levels and economic competitiveness.

But the principles are nevertheless welcome. And I am happy to endorse them.

THE RULES OF FISCAL POLICY

The principles, however, only take you so far. There is clearly room for huge differences of judgement in the way in which the principles are applied and it is in partial recognition of this that Gordon Brown has attempted to convey at least the impression of rigour by the introduction of his two fiscal rules. The first rule is that the Government will only borrow to finance net capital spending. This is the so-called ‘golden rule.’ The second – the ‘sustainable investment rule’ – is that, over the economic cycle, the ratio of net public sector debt to GDP should be set at a stable and prudent level, defined by the Chancellor as 40% of GDP.

The Chancellor has, of course, made great play of these rules. When announcing them to Parliament in June 1998, he claimed that they would go a long way to ending ‘once and for all’ boom and bust, a claim with which manufacturers and others might currently take issue. This would, in turn, he said, enhance stability and long-term investment in public services, thus enabling the country to achieve its potential.

The casual observer might therefore be left with the impression that these rules are rather powerful. In fact the gloss from the Treasury is such that Gordon Brown is often presented either as a modern day version of Gladstone or as the 21st Century reincarnation of Philip Snowden.

But the principles behind these rules are not new. They build on the approach taken by the Government’s Conservative predecessors. Ken Clarke’s Red Book in November 1996 stated: ‘Fiscal policy’s role is to maintain sound public finances. The Government’s fiscal objective is to bring the PSBR back towards balance over the medium term, and in particular to ensure that when the economy is on trend the public sector borrows no more than is required to finance its net capital spending’ (parag 2.09). Not only was the PSBR projected to fall to close to balance in 1999-2000, with a surplus thereafter, but net public sector debt was forecast to fall below 40 per cent of GDP in 2001-2.

The sustainable investment rule, which constrains public debt, has a particularly interesting pedigree. As early as 1976, Tim Congdon proposed, as part of a wider programme, a maximum ratio of public debt to GDP. He pointed out that a large deficit, which implied a rising ratio of debt to GDP, would result either in the crowding out of private sector investment or inflation. His analysis was incorporated into policy making in the 1980’s.

It is indeed gratifying that the present Chancellor has recognised the fact that an excessive budget deficit might risk excessive debt interest and, consequently, unnecessary taxation. But belated recognition is one thing. Fresh discovery is another. This approach did not start in 1997.

THE FLEXIBILITY OF THE RULES

Nor are these rules the all-encompassing ‘final word’ on fiscal policy that Government rhetoric would imply. The Institute of Fiscal Studies, for example, has said the rules are not ‘sacrosanct.’ It refers to them as ‘probably best regarded as sensible rules of thumb, but they are no more than that.’ I rather agree with this view.

At first sight, for example, there is some logic in terms of intergenerational fairness behind the golden rule. It seems equitable that each generation should pay fully for the spending that benefits them but should not have to pay for the spending that will benefit other generations. But even here, the rule is not perfect. Some spending that does not produce a durable physical asset nevertheless yields benefits to future generations – such as the defence spending during the last War, as Marc Robinson has pointed out in a paper for the IFS. Furthermore there may also be cases where future generations have to pick up the bill in a way that is acceptable under the golden rule – for example in respect of civil service pension liabilities.

But there are yet bigger problems when we look at the rules in more detail.

For example, the golden rule allows the ratio to be defined over the ‘economic cycle.’ This cycle is very difficult to define and as such gives the Chancellor considerable creative scope in assessing whether the rule has been met.

When I recently asked the Chancellor, in a written Parliamentary Question, for clarity on this matter, he referred me to the Red Book. This is what the relevant passage of the Red Book says:

‘Given the closeness of output to trend throughout 1997 to 1999,possible measurement errors and the prospect of further data revisions, it remains difficult to conclude for certain that the UK economy has completed a full, albeit short and shallow, economic cycle between the first half of 1997 and mid-1999. For the purposes of the Budget and the assessment of performance against the fiscal rules, the provisional judgement remains that a cycle may have been completed by mid-1999 when the current cycle is assumed to begin’ (Budget 2001, March 2001, para 2.36).

I am not sure that that makes it very much clearer what the Chancellor means but I hope you understand what I mean.

How is anyone supposed to hold the Chancellor to his test of the golden rule – supposedly cast iron, water-tight, a lynchpin of his entire approach – when it is so difficult to determine, at least until well after it has been completed, when the cycle to which it refers has started or ended?

And of course, the golden rule only constrains borrowing in relation to what is defined as current spending. This means that Governments can spend substantial amounts of money while keeping the golden rule. As the IFS have pointed out: `In the late 1960s and early 1970s, the golden rule was met. This was not because public sector net borrowing was particularly low, but because public investment at the time was high’ (Briefing Note, January 2001, p. 3).

OUR APPROACH TO THE RULES – SCRUTINY AND TRANSPARENCY

So what approach should an incoming Government take to these rules?

The Treasury has itself acknowledged that there is a balance to be struck between ‘a rigid mechanical approach and an approach based on unfettered discretion.’ I agree. And actually achieving this balance – ensuring that the rules are neither unachievable in a recession, nor so loose as to be meaningless – is, I agree, extremely difficult.

Two conclusions follow.

First, no Chancellor should seek to load greater authority onto the rules than they will bear. Gordon Brown’s attempt to dress up these rules as a return to some form of exceptionally rigorous Gladstonian fiscal orthodoxy is, I am afraid, wholly bogus.

Second, the rules need to be buttressed by other measures.

THE NEED FOR SCRUTINY

The best means of achieving this is through improved and more objective parliamentary scrutiny.

I have already proposed improved scrutiny of appointments to the Monetary Policy Committee. What scope is there for improving parliamentary scrutiny in the fiscal area?

One possibility would be to equip Parliament with an agency that could offer serious analysis of spending, borrowing and taxation in a manner comparable to that achieved by the Congressional Budget Office in the United States. It would mean that all the Treasury decisions could be authoritatively challenged by an objective agency accountable to Parliament.

Under the present arrangements, the National Audit Office and the Public Accounts Committee enable the legislature to scrutinise the previous actions of the Executive after the event. This work is exceptionally valuable, but Parliament should also be intellectually equipped and capable of properly challenging the Government as it develops its policies. And there is no more central area for this task than fiscal policy: spending, taxing and borrowing.

THE NEED FOR TRANSPARENCY

But for scrutiny to be effective a degree of transparency is necessary. Indeed, transparency is the first of the Government’s five principles. If this principle is to be achieved it must be possible for the facts on which debate is based to be capable of being established and, if possible, agreed. But one of the worrying developments since 1997 has been the increase in obfuscation from the Treasury. I am not talking here about the repeated reannouncements of spending proposals – those spinning Balls are easily caught.

I am talking about something much more insidious.

As the Financial Times has said: `Unfortunately, in many respects Mr Brown has reduced Budget transparency to a new low. Important tax changes have been omitted from the speech… Statistics have rarely been quoted on a consistent basis. The Budget documentation has been filled with political point-scoring rather than factual analysis. And there has been a continued tendency to classify the collection of revenue as anything other than taxation’ (2 March 2001).

Let us take a few of these points in turn.

We have become accustomed to the phenomenon of discovering after a Budget Statement that some very important measure has been buried in some obscure footnote. The extent of the £5 billion a year raid on people’s pension funds was not mentioned in the relevant Budget statement, with a reference instead to `a long needed reform’ (Gordon Brown, col. 306, HC Debs, 2 July 1997). When the Chancellor introduced the new 10p starting rate in his 1999 Budget he neglected to mention that he was abolishing the existing 20p rate. And nor was his stealth tax on entrepreneurs – IR35 – mentioned in his 1999 speech. Instead, he said: ‘I want to recruit, motivate and reward Britain’s risk-takers’ (Gordon Brown, col. 177, HC Debs, 9 March 1999).

Another example is the far too little known fact that the Government has deliberately excluded the impact of indirect taxes when illustrating the effects of Budget changes on specimen households.

The public accounts themselves are now more opaque and confusing than for many years. The Budget Red Book has been transformed from a coherent document that lucidly explained economic policy to a discursive document that confuses more than it informs. Meanwhile its length has risen from 160 pages when we left office to 225 pages last year. The Finance Bill likewise has risen from 219 pages to 292 pages.

It is little wonder that one of the most serious criticisms that can be levelled against the Chancellor is the increasing complexity of the tax system. The Institute of Chartered Accountants, for example, has said that the tax system has ‘spun out of democratic control’ because of complexity, the number of anomalies and the ‘culture of never-ending change.’

I know that the CPS is looking at this problem of the ever-increasing complexity of the tax system and I very much look forward to your conclusions.

Clearly this also has implications for two more of the principles which the Government has established for fiscal policy – efficiency and fairness.

Complexity in the tax system does not lend itself to meeting either meaning of the term `efficient’: the efficient allocation of resources in the economy or the narrow definition in terms of efficient tax collection. Indeed it is a startling fact that the number of Inland Revenue staff has risen from fewer than 50,000 in 1997 to 64,000 now.

One of the reasons behind this growing complexity is the tendency of the Chancellor to intervene in just about every area where intervention is possible. I accept that there is a proper place for the use of the tax system to encourage particular kinds of behaviour which are regarded as economically and socially desirable. But any such intervention should be used sparingly – both because any tax break for some effectively raises tax rates for others and also because this very process, unless it is firmly controlled, tends to constitute an impediment to transparency.

Yet as the Economist has said: ‘The signs are, in fact, that in microeconomic policy Mr Brown’s every instinct drives him towards complication and activism….. The Chancellor is meddling because he thinks he knows best…. The Chancellor appears to forget that fiscal complexity feeds on itself; that it creates anomalies that call forth new rules and complications’ (The Economist, 13 March 1999).

It is also clear that much of the opaqueness which has arisen in recent years is deliberate. The national accounts and public finances should in principle be presented on the basis of internationally agreed accounting conventions. That is why the Chancellor’s decision to score the Working Families Tax Credit as a credit that reduces income tax and the tax burden rather than for what it is, a social security benefit that increases public expenditure, is so reprehensible. His approach to this question is entirely inconsistent with the internally agreed accounting conventions. The Treasury Select Committee has also noted that, under accounting conventions employed by the ONS, the OECD and ESA95, `…WFTC counts as expenditure’ (report on Budget 2000, April 2000).

Even if the Chancellor’s preference to score the measure as a tax credit rather than a social security benefit were acceptable, he has chosen to treat the WFTC and the old Family Credit benefit, which it replaced, in different ways. In historical data presented by Gordon Brown, Family Credit is scored as a social security benefit and is not netted off against income tax. This of course is the opposite of what he has chosen to do with the Working Families Tax Credit. The result is a higher total tax burden before the introduction of the change and lower one afterwards despite the fact that there has been no change of any kind in the essential approach. That is not transparency, that is deliberate obfuscation.

Where statistics are not consistent Government documents should highlight this and explain the reason for it. This is particularly important where the Government is choosing to present numbers in a way that departs from the agreed international conventions. And where previously available information has been dropped, it should once again be made available and in an easily accessible form.

CODE FOR FISCAL RESPONSIBILITY

The Government has emphasised, in this context, the introduction of the Code for Fiscal Responsibility. Treasury advisers claim that the Code strengthens the openness, transparency and accountability of fiscal policy.

However, it is clear that the principles in the Code – the fiscal principles I listed earlier – are not being observed. The Code itself, although approved by Parliament and supported by the Finance Act 1998, does not have the force of statute.

We may need to look at ways to give effect to some of the rhetoric employed at the time of the Finance Act 1998 and ostensibly enshrined in the Code for Fiscal Responsibility.

I would welcome a public discussion on the lessons that we can learn from our experience since the legislation of 1998, together with the experience of scrutiny that is available for example under the New Zealand Fiscal Responsibility Act and elsewhere.

This would also help to meet the fifth principle of fiscal management: fairness. It is certainly a principle to which I would subscribe. But it is not a principle which is likely to be met under an opaque and complicated tax structure. And the Government’s general performance in this area leaves a great deal to be desired. The tax burden for the poorest fifth of households rose from 37% to 41% in the first three years of Labour Government – the latest figures which are available. That is hardly the record of a Government with an equitable tax policy.

SPENDING

The final point I wish to make about fiscal policy is, in many ways, one of the most important of all.

Both the fiscal rules of course relate to inputs into the public spending equation. Yet the most important issue is the outcome of that spending – its effectiveness.

The Chancellor in the foreword to the Treasury book states that there was a need for `better planned public spending’ in 1997, which focused on `the quality of public service provision’. Yet it is hardly credible to claim either that public spending over the last five years was in fact better planned, or that the quality of public service provision has improved as a result.

There does need to be a rigorous approach to assessing the effectiveness of decisions about public spending and investment. Of course the Government claims that such an approach is already taken. And there is, indeed, Treasury guidance, set out in the `Green Book’, covering the need for cost-benefit analysis of spending decisions.

Treasury advisers also highlight public service agreements as the means by which attention is focused on outcomes rather than inputs. Yet these have not achieved that goal, not least because many of the targets are not being met.

An IMF working paper last year looked at these issues. It stated that UK Government authorities implicitly recognised that the golden rule was about how investment is financed, not about the optimum level of that investment. The paper went on to say: `it is particularly important that the details of how a “value for money” criterion will be implemented are clearly set out. But that is not yet the case in the United Kingdom’. It said, in relation to the Government’s requirement that each department publish a Departmental Investment Strategy, that the first strategies (in March 1999) contained little relevant information other than to refer to existing (non-mandatory) guidelines on investment appraisal.

So it is clear that not enough attention is being given to this vital area, one which is often overlooked in discussion of the fiscal rules.

CONCLUSION

I have today focused on the framework for fiscal policy, and have set out some suggestions for how it might be strengthened.

The Chancellor’s fiscal rules have an important role to play, but their limitations need to be acknowledged. They need to be buttressed through the introduction of a degree of objective scrutiny and transparency into fiscal policy. There also needs to be a greater focus on the outcome of the spending – rather than just the amount which is spent.

I will be focusing in future speeches on non-fiscal aspects of the supply-side economy. But it is important at this stage to recognise that the combination of ever higher taxes along with ever worsening public services, a less transparent tax system and employment regulations that make the labour market less flexible will, in the medium-term, depress the economy’s growth rate.

Beneficial supply-side reforms take a long time before their full effects on an economy are evident. The impact of damaging policies on the supply-side is also only clear after a lag, and the lags involved can be protracted. It is because these lags are so long that we need a properly informed debate about these issues now. The public finances should be accurately and intelligibly presented. And the institutional arrangements for presenting and scrutinising the government’s fiscal polices need to be strengthened.

Measures of this kind will not guarantee halcyon economic performance forevermore. But they would represent a clear improvement on the arrangements that are presently in place. I hope they can form the basis of informed debate during the rest of this Parliament.